Introduction to RAM’s Fixed Income Team and Investment Approach

Our Philosophy

Our Fixed Income team consistently employs a repeatable risk controlled approach in an effort to achieve results which exceed the specified benchmark over a market cycle. This philosophy has not changed since RAM’s founding.

- Helping our clients achieve their investment objectives is fundamental to everything we do at RAM

- We believe the best way to add value relative to a benchmark is through sector allocation and security selection

- Duration and term structure positioning are tightly regulated on a comparative benchmark basis

- Our Fixed Income team emphasizes our highest convictions expressed in varying degrees based on our relative value outlook

- The organization follows a team approach and takes a long term view on investing

Our Process

The investment process at our Fixed Income team is consistently implemented across all of our investment strategies. Our objective is to help our clients achieve their long term investment goals through diversification of holdings. We seek to add value across all risk attributes including duration, yield curve positioning, sector allocation and security selection.

- Our Fixed Income team employs a blend of top-down and bottom-up analysis at the center of our investment process

- The team follows a benchmark driven approach to top down decision making which is overseen by our Investment Committee

- We employ a compilation of quantitative and qualitative inputs in bottom up portfolio construction for sector allocation and security selection

- Relative value determination by portfolio managers and analysts are central to portfolio strategy implementation

- Risk management is central to our process and employed at all stages of portfolio management

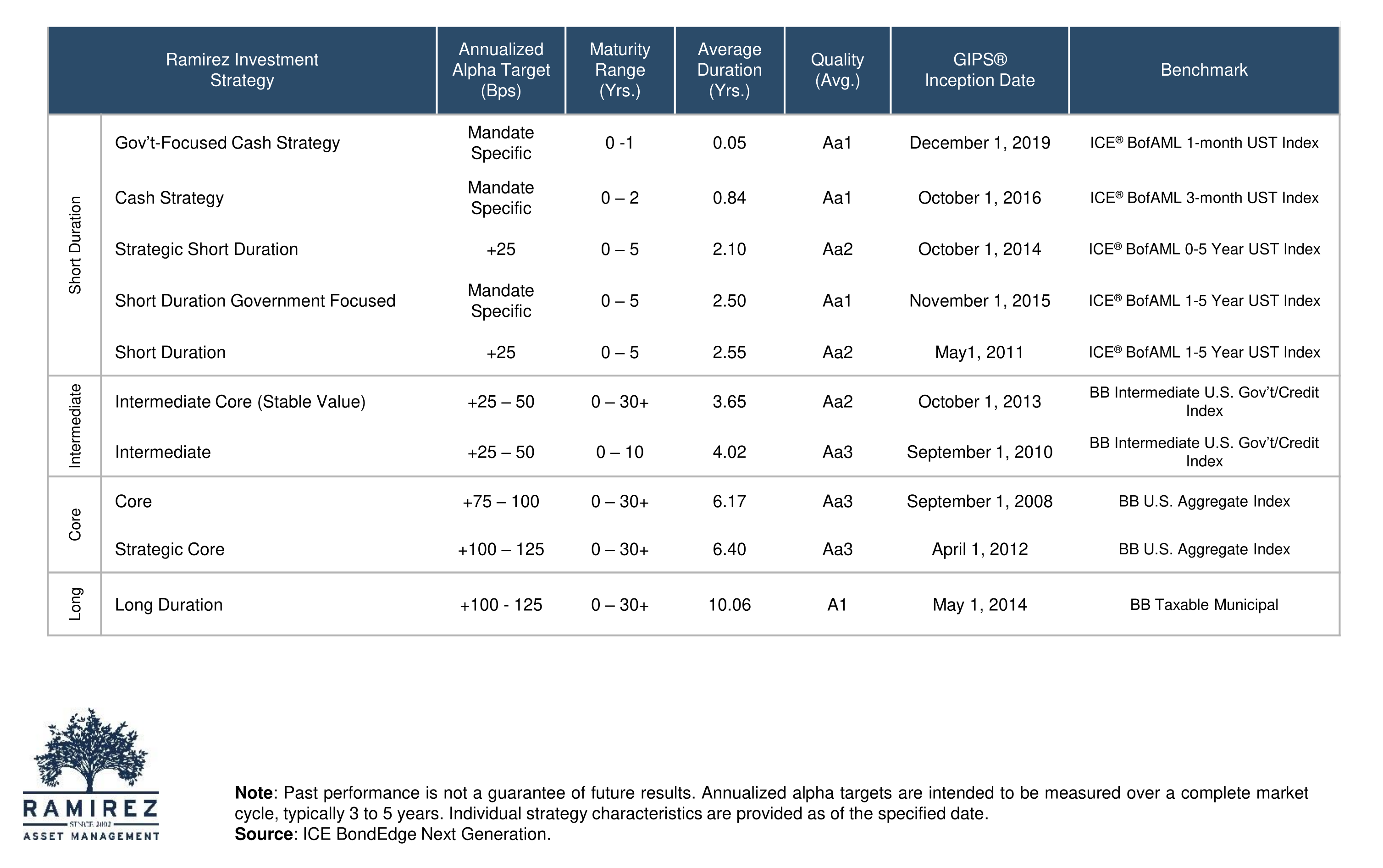

Strategy Summary

For more information on Ramirez Asset Management Performance & Strategies please Contact Us

Our Clients

We work diligently to customize separate accounts tailored to each of our individual clients’ unique goals and objectives. Our expanding client base includes some of the largest public pension funds in the country, Fortune 500 companies’ treasury and pension divisions, and numerous of other institutional groups.

To enhance transparency, our Fixed Income team offers all clients secure real-time access to their portfolios for review of their performance, current holdings, activity, and compliance status through our third party reporting and analytics software provider.

We also support investment consultants and professional advisors in their efforts to identify appealing partners for their client.

Further information about our firm and strategies can be found on most third party databases. Potential clients seeking further due diligence or interested in setting up a meeting should contact us directly.

Clients Served

Fixed Income Team

- At Ramirez Asset Management our single greatest asset is our employees. We are committed to attracting and retaining experienced, skilled individuals dedicated to the achievement of our client’s goals and objectives.

- Our team is composed of experienced professionals whose fixed income investment management personnel average over 20 years of industry experience. We utilize a consistent and disciplined process to help meet our clients’ goals and objectives.

- Our staff has access to first rate analytical, accounting, and trading systems to meet these goals. The various skill set of each employee is woven together to form a team with tremendous depth and experience in the analysis and management of fixed income portfolios. Please take a moment to read the biographies of our senior investment managers.

- SAMUEL A. RAMIREZ JR.

- President and CEO - Ramirez Asset Management

- Senior Managing Director - Ramirez & Company, Inc.

- LOUIS A. SARNO

- Managing Director, Portfolio Manager – Securitized Product

- HELEN YEE, CFA

- Senior Vice President, Portfolio Manager – Corporate Credit

- ALEX BUD, CFA

- Senior Vice President, Assistant Portfolio Manager – Municipals

Mr. Samuel A. Ramirez Jr. joined Ramirez & Co. as a managing director and fixed income specialist in July of 1992. During his over 30 year career at the firm, Mr. Ramirez, has led the development and growth of the Firm’s core divisions: institutional sales and trading, public finance, corporate banking, advisory, wealth management and institutional asset management. He has extensive industry knowledge and experience in managing financial businesses through various market cycles and conditions. His investment management experience includes a range of asset classes across the capital markets including municipal, corporate, mortgage, and government bonds, as well as TIPs and equities. In 2002, Mr. Ramirez established Ramirez Asset Management (RAM), an affiliated SEC registered RIA, which is focused on fixed income asset management for institutional public and private pension funds, corporations and state and local governments. He presently serves as a Senior Managing Director in Ramirez & Co. and President and CEO of RAM.

Sam has completed Executive MBA studies at the Tuck School of Business at Dartmouth College. Prior to Dartmouth, he earned a bachelor’s degree in Economics from the University of Vermont. Sam holds his Series 7, 24, 63 and 65 licenses. He is actively involved in New York-based business and civic organizations, including the Municipal Bond Club, Municipal Forum, the Museum of the City of New York, and several charities including the Catholic Big Sisters and Big Brothers, Little Sisters of the Assumption and Pegasus. Mr. Ramirez serves on the board of SIFMA and USPA Global Licensing and is a frequent keynote and industry expert speaker at events around the country.

Sam lives in New York City with his wife, Fabiana, and their three children, Carolina, Juliana, and Trey.

Mr. Louis A. Sarno is a Managing Director and Portfolio Manager of Ramirez Asset Management, focusing on institutional fixed income strategies. Mr. Sarno joined Ramirez in March 2010 and possesses over 32 years of institutional fixed income experience. From 2007 to 2010 he worked as the Chief Investment Officer of the Amalgamated Bank’s Institutional Trust & Custody department where he oversaw investments in excess of $11 billion. In that capacity, Mr. Sarno oversaw all investment offerings which consisted of fixed income, equities, and alternatives. From 1998 to 2007, Mr. Sarno was the Director of Fixed Income, with overall management responsibility for fixed income products and strategies which ranged from Cash out to Core. Mr. Sarno was a fixed income Portfolio Manager from 1992 to 1998 focused on Short and Intermediate duration fixed income portfolios.

Prior to joining Amalgamated Bank, Mr. Sarno served as a bond fund analyst at Bankers Trust Company. Mr. Sarno is a graduate of Fordham University with a B.A. in Economics and History.

Ms. Helen Yee joined Ramirez Asset Management in 2010 as a Senior Vice President and Portfolio Manager after 12 years managing fixed income portfolios at Amalgamated Bank. In 2007, she was promoted to Director of Fixed Income, overseeing strategy, day-to-day portfolio management, and risk analysis. Previously Ms. Yee was a fixed income portfolio analyst at Fiduciary Trust and J. & W. Seligman. Ms. Yee obtained an M.B.A. in finance from the New York University Stern School of Business and a B.A. in Economics from Oberlin College. A member of the CFA Institute, Ms. Yee is a CFA charter holder.

Alex Bud joined Ramirez Asset Management in April 2016 as a Senior Vice President and Assistant Portfolio Manager, specializing in Municipals. Mr. Bud possesses over 21 years of industry experience and 14 years of investment experience. From 2010 to 2016, he worked as a Portfolio Manager at FMS Wertmanagement Service GmbH responsible for the firm’s $6 billion US & Canadian Municipal bonds portfolio. From 2007 to 2010, Mr. Bud was a fixed income trader at Depfa Bank trading municipal tender option bond and interest rate derivatives. From 2004 to 2007, he was a risk manager at AIA LLC overseeing the day to day market risk for multiple Equities and Fixed Income portfolios. Prior to AIA LLC, he developed risk management application at UBS AG’s Prime Brokerage division. Mr. Bud obtained a B.S. in Computer System Engineering from Rensselaer Polytechnic Institute and he is a CFA charter holder.

- ZACH GROB

- Vice President - Securitized Product & ESG

- WILSON TRAN

- Senior Associate – Securitized Product

- KAREN FLORES

- Vice President - Municipals

- SETH EVANS

- Associate - Municipals

- EMRYS JONES

- Analyst and Junior Trader - Municipals

- JANET S. HENRY, CFA

- Senior Vice President – Corporate Credit

- SATYAM MALLICK, CFA

- Vice President - Corporate Credit

- BRETT RODGER

- Senior Associate and Trader – Corporate Credit

- KUSHAL MODI, CFA

- Vice President - Corporate Credit

- ROHAN ALUKA

- Analyst - Quantitative Credit

- ELAINE LI

- Associate - Credit & Portfolio

- BRYAN OESTERREICHER

- Senior Vice President, Equity

Mr. Zach Grob initially joined Ramirez Asset Management from 2014-2015 and returned in May, 2020 on a part time basis while completing his MBA. Mr. Grob rejoined as a full time employee in June 2020 after graduation and began serving as RAM’s ESG analyst with a focus on developing RAM’s approach and integration of ESG in its investment process. In January of 2022 he transitioned to the role of Securitized Analyst and has been working closely with the Securitized Portfolio Manager and broader investment management team. He is also charged with enabling and collaborating on the overall firm workflow through the utilization and building of different technology platforms. During his prior employment at RAM, Mr. Grob worked in the Operations and Marketing Departments. Prior to rejoining RAM in 2020, Zach spent four years with the Army’s 75th Ranger Regiment holding team leader and operations manager roles. As a result of his work overseas with the 75th Ranger Regiment Zach is classified as a disabled combat veteran. Mr. Grob holds an MBA from Fordham University’s Gabelli School of Business with concentrations in Finance and Information Systems and a BA in Political Science from the University of Connecticut.

Wilson Tran joined Ramirez Asset Management in July 2023 as a Senior Associate on the Securitized Products desk. Prior to joining RAM, Wilson spent his last 4 years at Semper Capital Management as an investment associate. In this role, he served as a trader primarily covering non-agency MBS and helped the firm manage portfolios across total return, absolute return and indexed based strategies. Prior to Semper, he was a senior consultant at Ernst & Young in the structured finance advisory practice specializing in valuation and modelling of securitized products. Wilson graduated from Syracuse University in 2016 with a B.S. in Finance and Accounting.

Emrys Jones joined Ramirez Asset Management in April 2024 as a Municipal Analyst / Junior Trader. Prior to joining RAM, Emrys supported J.P Morgan’s municipal secondary trading desk as a senior trading assistant where he covered Municipal, tender option bond, and municipal exotic products. Prior to J.P Morgan, Emrys worked at Barclays as a trading assistant, covering the Municipal secondary desk with a specialization in municipal cash products. Prior to Barclays, Emrys started his career as an investment analyst for Peapack-Gladstone bank (Now Peapack Private), supporting portfolio managers in managing over $10billion AUM.

Ms. Janet S. Henry is a Senior Vice President whose primary responsibilities include the fundamental research and valuation analysis of fixed income corporate credit. She has 40 years of investment experience. Prior to joining RAM in 2013, Ms. Henry was a senior credit analyst at Holland Capital Management for 13 years. Ms. Henry was a founding partner with Heartland Trading Group, a Commodity Trading Advisor. Previously she was with Aon Corporation, where she was a Senior Portfolio Manager in the asset management division and researched and managed $2 billion of domestic corporate bonds and structured mortgage backed securities in fixed income portfolios. She earned an M.B.A. from the University Of Chicago Booth School Of Business and a B.A. in history from DePauw University. Ms. Henry received the Chartered Financial Analyst designation in 1989. Ms. Henry is a member of the CFA Society of Chicago and the CFA Institute.

Ms. Satyam Mallick joined Ramirez Asset Management in September 2020 as Vice President and Corporate Credit Analyst. Ms. Mallick has over 22 years of experience as an investment professional having covered a variety of asset classes and industries. In addition, Ms. Mallick has covered the financial markets from different perspectives having worked on the sell-side, buy-side and at a rating agency. Prior to Ramirez Asset Management, Ms. Mallick spent 10 years on the sell-side at Susquehanna International Group (SIG) where she was the Head of Investment Grade Credit Strategy. Prior to SIG, she spent 7 years on the buy-side at Utendahl Capital Management as a Principal focusing on U.S. Investment Grade Credit Research. Ms. Mallick was an Assistant Vice President covering over 15 investor-owned utilities across the US at Duff and Phelps Credit Rating Company (now a part of Fitch). Ms. Mallick started her career in fixed income research as a Municipal Analyst at Nuveen in Chicago. She holds an M.B.A from Michigan State University and a B.A in Economics from Rutgers University. Ms. Mallick also holds a Charter Financial Analyst (CFA) designation.

Mr. Brett Rodger is a member of the fixed income investment team at Ramirez Asset Management. He has been with RAM since joining as intern in 2016 in the Operations and Client reporting departments. He is a graduate of Rhodes University with a Bachelor of Commerce (Honors) in Financial Management.

Mr. Kushal Modi joined Ramirez Asset Management in November 2024. He brings 10+ years of credit research experience to RAM. Most recently, Kushal worked as a Senior Credit Analyst at BMO Global Asset Management in Toronto, Canada where he covered global financials within corporate credit. Prior to that, Kushal has worked as a credit rating analyst at Morningstar DBRS and Moody’s Investor Services and has briefly worked in commercial lending. Kushal has a Master of Finance from Queen’s University, Kingston, ON, an MBA from NMIMS University, Mumbai, India and a Bachelors in Computer Science from University of Mumbai. He is a CFA Charterholder.

Rohan Aluka is an Investment Analyst at Ramirez Asset Management. Mr. Aluka initially joined in September 2023 as an intern through the Braeburn Fellowship Program. Upon graduation, Rohan returned full-time to work on quantitative credit research. Prior to this, Mr. Aluka has gained experience as an Investment Banking Summer Analyst at Akin Bay Co and as an intern in the Young Professionals Program at the RockCreek Group. Mr. Aluka graduated from NYU's Stern School of Business in 2024, earning a B.S. in Business with a concentration in Finance.

Mrs. Karen Flores joined Ramirez Asset Management (RAM) in July 2024. Mrs. Flores brings 25+ years of experience to RAM, most recently spending 17 years as Director of Credit Research at Charles Schwab Investment Management with a particular experience in municipal bonds. Prior to her time at Charles Schwab, Karen spent 10 years at S&P as a municipal bond analyst. Mrs. Flores has Master of Public Policy from the University of Chicago, Harris School of Public Policy and a Bachelors of Arts in Political Science from the University of California Berkeley.

Seth Evans joined Ramirez Asset Management (RAM) in July 2024. Prior to joining RAM, Mr. Evans provided credit research and ratings support to the Transportation and State & Local Government sectors while at S&P Global Ratings. Mr. Evans has over ten years of experience having previously worked in municipal banking serving mainly as a generalist with special focus on transportation, higher education and water sectors. Mr. Evans received his MBA in International Finance from the Kellogg School of Management.

Elaine Li joined Ramirez Asset Management in 2024 as a Credit & Portfolio Analyst. Prior to joining RAM, Miss Li served as a Portfolio Associate at PIMCO. In this role, she collaborated closely with Emerging Market desks to monitor risk measures and position weights in relation to investment guidelines and benchmarks. Before her tenure at PIMCO, Elaine was an Audit Senior in the Wealth Management group at Ernst & Young. Elaine holds a B.S. from Northeastern University and an M.S. in Finance from Georgetown University.

Mr. Bryan Oesterreicher has been working for Samuel A. Ramirez & Co. as an Analyst since September 2001. He began his career with Merrill Lynch in 1995 as a Financial Consultant managing portfolios for high net worth clients but then moved into research to be an Analyst working with Merrill Lynch Asset Management. In 2001 he then moved to head the research and portfolio management group at Marquette de Barry and eventually joined SAR to perform equity, mutual fund and hedge fund research for the Retail Sales Group. Bryan currently manages the Equity Strategies for RAM and is on the Ramirez Asset Management Investment Committee performing risk management and investment strategy allocation analysis.

- PETER SIGISMONDI

- Chief Compliance Officer

- IRA I. ISAGUIRRE

- Chief Risk Officer

- MAODO NDIAYE

- Quantitative Analyst

- DMITRO GOLOVANICH, PhD

- Quantitative Analyst

- DAVID BRIONES

- Quantitative Analyst

Peter Sigismondi joined RAM in October 2011 and has served as the firm’s Chief Compliance Officer (“CCO”) since July 2012. He brings 28 years of industry experience serving in compliance, regulatory and supervisory roles. Prior to joining RAM, he served as a compliance officer for Goldman Sachs from 2000 to 2011 and a supervisor of examiners for FINRA (formerly NASD) from 1996 to 2000. He holds an MBA in Finance from Seton Hall University Stillman School of Business and a BA in Economics and English from Rutgers University. He is a member of the National Society of Compliance Professionals and SIFMA, and has obtained numerous industry licenses (i.e., Series 4, 7, 9, 10, 14, 24, 53, 57, 63, and 99).

Mr. Ira I. Isaguirre is Chief Risk Officer of Ramirez Asset Management Portfolio Management Group and has over sixteen years of industry experience. Prior to joining RAM in 2010, he was an Assistant Vice President at Amalgamated Bank responsible for the analytical and statistical review of clients’ cash flow sufficiency, investment performance, attribution and risk management for the bank’s equity and fixed income products. He was also responsible for maintaining the bank’s GIPS® compliance. Mr. Isaguirre graduated magna cum laude from the City College of New York with a BA and MA in Economics.

Maodo Ndiaye joined Ramirez Asset Management in February 2022 as a Macro Quantitative Analyst. Prior to joining RAM, Maodo spent three years at American Century Investments focused on Global Fixed Income and Emerging Market Debt Strategies working on portfolio analytics, performance attribution, quantitative investment tools, and fundamental and sovereign analysis to support the investment team. He also spent time as an Investment Analyst at the Alfred P. Sloan Foundation and worked in France at Carmignac Gestion as a Performance Attribution Executive in Fixed Income where he worked directly with fund managers and product specialists on performance analyses and reporting. Earlier in his career, Maodo worked for BNP Paribas Asset Management as an Investment Specialist Assistant, Euro Sovereign and Aggregate Fixed Income where he assisted Portfolio Managers in their investment monitoring, reporting activities and business development.

Ndiaye holds a MSc. in Statistics from the National School for Statistics and Information Analysis (ENSAI) and a MSc. in Portfolio Management from IAE Gustave Eiffel in France.

Dmitro Golovanich is a Quantitative Analyst working on firm-wide systems and quantitative capabilities at Ramirez Asset Management. Mr. Golovanich has been with RAM since December 2021 after graduating from the University of North Carolina at Chapel Hill with a PhD in Mathematics. He also hold a B.A. and M.S. in Mathematics from the University of Colorado at Boulder.

David Briones joined Ramirez Asset Management in 2023 and is a member of the Risk and Quantitative Systems team. Prior to joining RAM, David was an asset-backed securities analyst on Citigroup’s securitized desk. David graduated summa cum laude from Central Connecticut State University and holds a B.A. in Economics and Philosophy. David is currently pursuing the CFA designation.

- CHERYL FUSTINONI

- Head of Operations

- ALLEN KHANCHIK

- Senior Operations Associate

- DORIS VAZQUEZ

- Operations Associate

- FRANCO LOGOZZO

- Operations Associate

Cheryl Fustinoni joined RAM in March 2021 as Head of Operations of Ramirez Asset Management with over sixteen years of industry experience. Prior to joining RAM in 2021, Mrs. Fustinoni was Head of Operations at Matarin Capital, and was responsible for all of their middle and back office functions, including maintaining the accounting system, processing of trades, and reporting to clients. Prior to Matarin, Cheryl was a senior operations associate at Lake Partners, an alternative mutual fund. Mrs. Fustinoni graduated from the University of North Texas with a BBA and has graduate work at Pace University.

Allen Khanchik joined Ramirez Asset Management (RAM) as an Operations Associate in December 2020, following his role as Operations Manager at Samuel A. Ramirez & Co., Inc. Prior to that, Mr. Khanchik served as an Operations Associate and Emerging Markets Trader Assistant at SecureVest Financial Group. He brings over a decade of experience in the financial services industry, having held various roles across broker-dealers, including Municipal Trading Assistant, as well as positions in Back Office, Middle Office Operations, and Compliance support. Mr. Khanchik holds a B.S. in Finance from the Smeal College of Business at Penn State University.

Doris Vazquez joined RAM in 2019 as Fixed Income Operations Analyst with over 17 years of industry experience. Prior to joining RAM in 2019, Mrs. Vazquez was the Operations Manager at Samuel A. Ramirez & Co., and was responsible in assist the Managing Director in AML and CIP surveillance, reporting (MSRB, TRACE, among others) and regulatory examinations; processing of trades, and monitor and control wire transfer and third-party transactions. Prior to Samuel Ramirez, Doris was the operations assistant at RG Investments (2005-2006), Operations Supervisor at Wachovia Securities (2002-2005) and Operations Clerk at Morgan Stanley-Dean Witter (2001-2002). Mrs. Vazquez graduated from the University of Puerto Rico, Rio Piedras Campus with B.A. Secondary Education.

Franco Logozzo is an Operations Associate who joined RAM in October 2024. Some of Mr. Logozzo’s daily responsibilities are processing our daily Repo trades, trade processes with custodians, helping daily trade settlements, and ensuring trade information is correct before approval. Prior to joining RAM, Mr. Logozzo worked at Oppenheimer Co & Inc, Margins and ACATs department. Mr. Logozzo graduated from St. Joesph’s University in 2023 with a B.S. in Marketing.

- JAMES F. HADDON

- Managing Director, Head of Client Service & Marketing

- DAVID TUCKER

- Senior Vice President, Intermediary Marketing

- MICHAEL FINCK

- First Vice President, Client Service & Marketing

- AIDAN CAGE

- Senior Associate, Client Service and Marketing

- ANGELINE PAREKH

- Analyst, Client Service and Marketing

Mr. Jim Haddon has over 41 years’ experience in the asset management and investment banking business. At RAM he is responsible for marketing RAM’s fixed income products and services to pension funds, state and local governments and corporations. In addition he provides client service for select accounts. Mr. Haddon reports directly to Sam Ramirez Jr. and also focuses on developing marketing strategies to grow RAM’s assets management business. Prior to RAM, Mr. Haddon was employed for 5 years at PFM Asset Management where he was a Managing Director responsible for National Account marketing. Prior to PFM Asset Management he worked at Citigroup in various asset fundraising and investment banking roles. He earned a bachelor’s degree in economics from Wesleyan University and an MBA from Stanford University and holds his Series 7, 53 and 63 licenses from the Financial Industry Regulatory Authority (FINRA).

Michael Finck joined Ramirez Asset Management in 2016 and is a member of its Client Service and Marketing team. At RAM, he is responsible for managing client relationships, marketing the firm’s fixed income products, and developing new business opportunities. Prior to joining RAM, Mike was a research specialist covering the municipal primary markets at ICE Data Services. Mike holds a B.S. in Finance from Seton Hall University.

David Tucker joined Ramirez Asset Management in 2024 as Senior Vice President of Intermediary Marketing. He is responsible for the distribution of RAM’s SMA, UMA & Mutual Fund strategies to financial intermediaries. Prior to RAM, Dave spent the past year as a Senior Client Relationship Manager at startup Curasset Capital Management. Prior to that, he spent 5 years as the Head of Financial Intermediary distribution for Pinnacle Associates and 5 years as Head of US Sales for Centre Asset Management. Dave brings over 25 plus years of industry experience and provides a unique, consultative value proposition to his client base. He will continue to provide client-centric investment solutions for RAM. Dave holds a B.S. from St. John’s University, is a member of the Investments and Wealth Institute and holds his Series 6. 63 & SIE licenses from FINRA.

Aidan Cage is a member of the Client Service and Marketing team at RAM. Miss Cage has been at RAM since December 2020 working in the client service and marketing department as well as on a number of firm-wide diversity, equity, and inclusion initiatives. Miss Cage holds a bachelor’s degree from George Washington University.

Angeline Parekh is a Marketing Analyst at Ramirez Asset Management. Following her summer internship at RAM, Miss Parekh joined RAM full-time in August 2022 working in the client service and marketing department. Miss Parekh holds a B.S. in Marketing and Real Estate from Florida State University.